Raising Financially Successful Children

(NAPSI)—Good news for parents: You can help your kids learn to do well. Studies suggest a clear correlation between early education in money and future financial success.

Financially Educated Children Become Financially Successful Adults

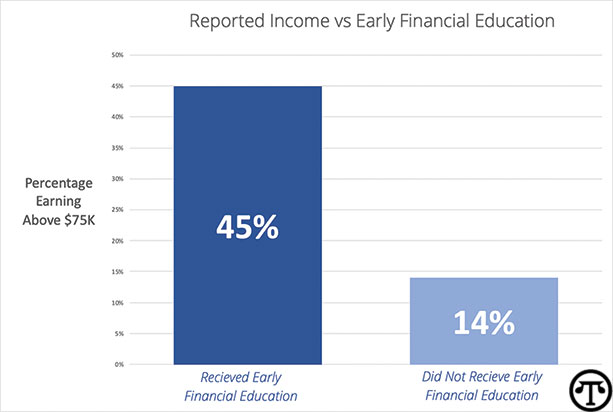

People who learned about money as children were three times as likely to have a personal annual income of $75K or higher than those who didn’t, according to a survey by Quicken, maker of the best-selling personal finance software in the U.S.

But there’s a problem: One-third of adults surveyed said no one taught them about money when they were children. Among that group, only 13 percent report a high level of confidence in their finances.

How Does Your Own Upbringing Influence What You Teach Your Kids?

People who learned about money as children were 20 percent more likely to prioritize teaching their own kids about money. Those who said no one taught them about money as a child were twice as likely to delay talking to their own children about money until age 18 or older.

Teaching Tools

The top tools—allowance, savings accounts, piggy banks—may not have changed much, but the lessons have evolved. Today, parents are teaching their children about charitable giving 60 percent more than their own parents did, using credit cards as teaching tools almost 50 percent more, and teaching their kids about investing 85 percent more than the people who taught them about money.

Money Talk Tips

To help your family discuss finance, try these three ideas:

1. Set an example. If you’re an example of financial responsibility, your kiddos will be more likely to follow.

2. Use tools. The right tools can make a big difference. The survey showed that 62 percent of the people who do not use any personal finance tools also reported a lack of confidence in their current financial situation.

3. Talk early and often. An early start and frequent conversations about money can be key to setting your kids on the path to a healthy financial future.

“People who learned about money as children were three times as likely to have a personal annual income of $75K or higher than those who didn’t, according to a survey by Quicken, maker of the best-selling personal finance software in the U.S. http://bit.ly/2ZQqcR1”