Hope For Future Generations Inspires First Insurance Policy Exclusively For Infertility Treatments

(NAPS)—Growing a family starts a new chapter of life. And in 2020, parents may feel like it’s more than a chapter: It’s a whole new book. Each chapter has high expectations (and a price tag), including Parenting Styles; Keeping Baby Healthy; What to Eat; What to Wear; School—Public, Private or Home; Minding Your Money; Investing for Your Future (and Theirs); and so many more. The cost of raising a child becomes clearer and clearer.

Truth is, your bundle of joy adds about $13,000 a year to your

budget through age 17, and that doesn’t include the cost of a college

education (source: Bureau of Labor and Statistics, Consumer Expenditures

Survey). Whether the new member of your family is two weeks, two years,

12 or 22 years old, you’re always evaluating your and their financial

future. Are you well insured? Saving and investing for your retirement?

Planning for their education?

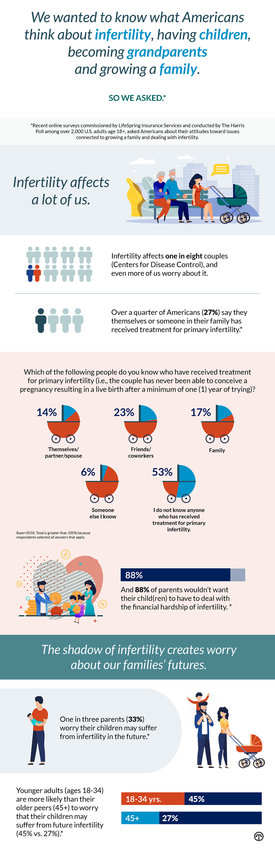

And a recent survey of American parents reveals a new concern: A

third of parents (33%) worry their children may suffer from infertility

in the future.*

One in eight U.S. couples will face a diagnosis of primary

infertility—the inability to become pregnant after a year of trying

without contraception (source: 2006-2010 National Survey of Family

Growth, Centers for Disease Control). LifeSpring Insurance Services

and The Harris Poll conducted an online survey of over 2,000 U.S.

adults age 18+, asking Americans about their attitudes toward issues

connected to growing a family and dealing with infertility. In fact,

when you ask individuals how they’ve been affected, primary infertility

has caused more than a quarter of Americans/their families to seek

treatment for it.*

Most Americans think treatments should be affordable for anyone

who needs it*, and the founders of Life-Spring Insurance Services, Jason

Muesse and Eugenie Shea, agree. It’s why they spent years designing an

affordable policy that’s currently available in Texas with plans to

expand to other states in 2020. Their goal is to help ensure the next

generation has access to healthcare treatments for primary infertility,

should they need it. “Seeing friends and family experience the physical,

emotional and financial stress of treating primary infertility drove me

to analyze how insurance could help,” says LifeSpring CEO Jason Muesse.

“It took five years to research and design this policy, and we believe

it can help solve the financial stress of infertility for the next

generation of parents.

“We are removing the stressful financial barrier between tomorrow’s young couples and their dreams of family,” Muesse adds.

Shea, too, is passionate about innovating how healthcare costs,

like infertility, are insured because they can improve a family’s

quality of life and give financial security. “Coping with infertility

and deciding how to pay for treatments can be paralyzing, and the cost

of treatment may stop some families from pursuing having children. We

want to change this because we believe that giving others the

opportunity for a family is the greatest gift,” Shea says.

The Harris Poll survey also found a majority of parents say

giving their children an opportunity to become parents is important.

Even among parents of kids under 18, nearly half—45%—would be interested

in a health insurance policy to protect their children from future

primary infertility.

Because LifeSpring is dedicated to changing how treatments for

primary infertility are insured for the next generation, its innovative

early-life approach offers today’s adults an opportunity to give the

next generation hope and the financial resources to pursue it. Its

unique, deferred-benefit policy gives future generations facing primary

infertility the financial resources to have their own biological

children without the significant personal expense.

Survey Methodology: Two surveys were

conducted online within the United States by The Harris Poll on behalf

of LifeSpring: *October 15-17, 2019 among 2,018 U.S. adults ages 18 and

older among whom 1,172 are parents, and ** September 19-23, 2019 among

2,076 U.S. adults ages 18 and older among whom 819 are parents of

children 18 and under. These online surveys are not based on a

probability sample and therefore no estimate of theoretical sampling

error can be calculated. For complete survey methodology, including

weighting variables and subgroup sample sizes, contact LifeSpring

Insurance Services.

““For one in eight couples, the path to parenthood has obstacles” says Jason Muesse, CEO of LifeSpring Insurance Services. “We are removing the stressful financial barrier between tomorrow’s young couples and their dreams of family.”http://bit.ly/2uS2ae2”