Financial Difficulties During a Global Pandemic: Why It Is Important To Start Saving For Retirement, Despite Your Age

(NAPSI—The COVID-19 pandemic has impacted Americans in more ways than one. With the ups and downs the market has experienced since the start of the pandemic, it’s important that working Americans understand their various financial and retirement planning options.

According to a recent survey from the Center for a Secure Retirement and Bankers Life, more than half (54%) of working adults say their retirement planning has taken a hit amid the COVID-19 pandemic, with more than a third (36%) having lost money in the stock market.

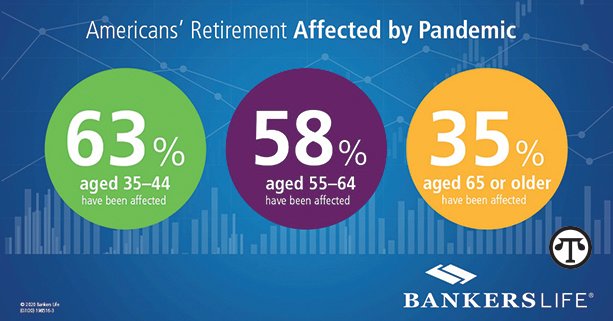

Whether you’re 25, 35 or 45, it’s never too early—or late—to start financially planning for retirement. Additional insight from the Center for Secure Retirement shows that nearly two-thirds (63%) of those age 35 to 44 reported that the pandemic has impacted their future retirement, compared to just one-third (35%) of those 65 and older.

A moment of upheaval like that experienced amid COVID-19—which has been particularly felt by those reliant on employer sponsored plans like a 401(K)—represents an opportunity for the next generation of retirees to review their options and ensure their financial security.

Here are smart actions to take:

•Stay calm. The uncertainty of the market can cause panic for some. Financial planning experts advise that the best thing you can do is to refrain from impulsive decisions. Stay calm and avoid any emotional or risky moves when it comes to large investments.

•Reevaluate. Even for those who may feel confident in their retirement planning, it is important to continually reevaluate as you receive new information during the pandemic. It can be tempting to focus on short term gains at the expense of long-term plans.

•Be flexible. It may even be beneficial to schedule reviews of your retirement plans several times over the course of the year, as the state of the world is everchanging. Continuously revisiting and adjusting your plans will ensure that you are prepared for the future no matter what it may bring.

•Supplement savings. Consider including life insurance as part of your retirement plan to supplement your savings and provide peace of mind for you and your loved ones.

Although life during a pandemic is uncertain and difficult to navigate, by seeking help to better understand your financial plans and current health care coverage, you’ll be more prepared to anticipate unforeseen situations in the future.

•Bankers Life is the marketing brand of Bankers Life and Casualty Company, Medicare Supplement insurance policies sold by Colonial Penn Life Insurance Company and select policies sold in New York by Bankers Conseco Life Insurance Company (BCLIC). BCLIC is authorized to sell insurance in New York.

“Whether you’re 25, 35 or 45, it’s never too early—or late—to start financially planning for retirement.https://bit.ly/3mVmIZ8“