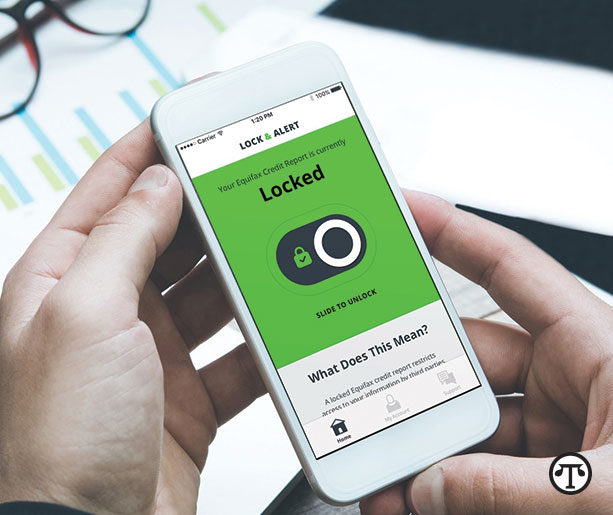

(NAPSI)—When it comes to restricting certain access to their Equifax® credit reports, consumers have a new option with the Equifax Lock & Alert™ service. The service, which was launched on Jan. 31, is free for life and gives consumers the ability to quickly lock and unlock their Equifax credit report using a computer or mobile device. Terry Griffin, senior vice president of marketing at the Equifax Global Consumer Solutions division, answers some questions surrounding Lock & Alert.

Q: Why did Equifax launch Lock & Alert?

A: One of the reasons we launched Lock & Alert (https://www.equifax.com/personal/products/credit/credit-lock-alert) was to provide consumers with another option for restricting certain access to their Equifax credit report. Doing so may help protect against identity thieves fraudulently opening credit accounts or new loans. One way to restrict certain access to your credit reports is through a credit report lock. Lock & Alert also represents a commitment we announced on Sept. 27, 2017, to provide a service that allows consumers to help control access to their Equifax credit report in an easy and convenient way. In addition, we have also waived the fees for security freezes − including placement, lifting, and removal − until June 30, 2018.

Q: How have consumers responded so far to Lock & Alert?

A: We are carefully watching and addressing consumer feedback. We’re pleased to see some positive reviews, comments, and high ratings in the Apple® App Store or Google Play™. Through those, we’re able to see what’s resonating with consumers and where we have opportunities to improve. Our teams are diligently responding to comments, and we encourage additional feedback.

Q: What is the difference between Lock & Alert and a security freeze?

A: A credit report lock and a security freeze have the same impact on your Equifax credit report, but they aren’t the same thing. Both generally prevent access to your Equifax credit report to open new credit accounts. A lock allows you to lock and unlock your Equifax credit report online or by mobile app, and uses usernames and passwords for identity authentication. Placing, lifting or removing a security freeze can also be done online, and uses a PIN for identity authentication. Unless you temporarily lift or permanently remove a freeze, or unlock your Equifax credit report, it can’t be accessed to open new accounts. There are exceptions as to who can still access your Equifax credit report when it’s locked or frozen. For more information about the differences between a security freeze and a credit report lock, please click here (https://www.equifax.com/personal/education/identity-theft/lock-or-freeze-infographic).

Q: Do consumers who have the complimentary credit monitoring product need to sign up for Lock & Alert too?

A: All U.S. consumers who are at least 18 and have an Equifax credit report are able to enroll in Lock & Alert regardless of whether or not they are enrolled in our complimentary credit monitoring. Consumers are not obligated to enroll in Lock & Alert; whether to enroll in the service is a consumer’s choice.

“Lock & Alert represents a commitment Equifax® announced on Sept. 27, 2017, to provide a service that allows consumers to help control access to their Equifax credit report in an easy and convenient way. http://bit.ly/2EyhYXu”